VaR Using Historical Simulation

Gurdip Dhami

25 years: Treasury & ratings

Discover how Historical Simulation estimates VaR using real past market moves. See how percentile-based losses define risk, how to scale 1-day VaR to longer horizons, and why data quality and time periods are critical to reliable results.

Discover how Historical Simulation estimates VaR using real past market moves. See how percentile-based losses define risk, how to scale 1-day VaR to longer horizons, and why data quality and time periods are critical to reliable results.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

VaR Using Historical Simulation

16 mins 43 secs

Key learning objectives:

Understand how Historical Simulation uses real market data to estimate potential portfolio losses

Apply the six steps of the Historical Simulation VaR method in Excel or Python

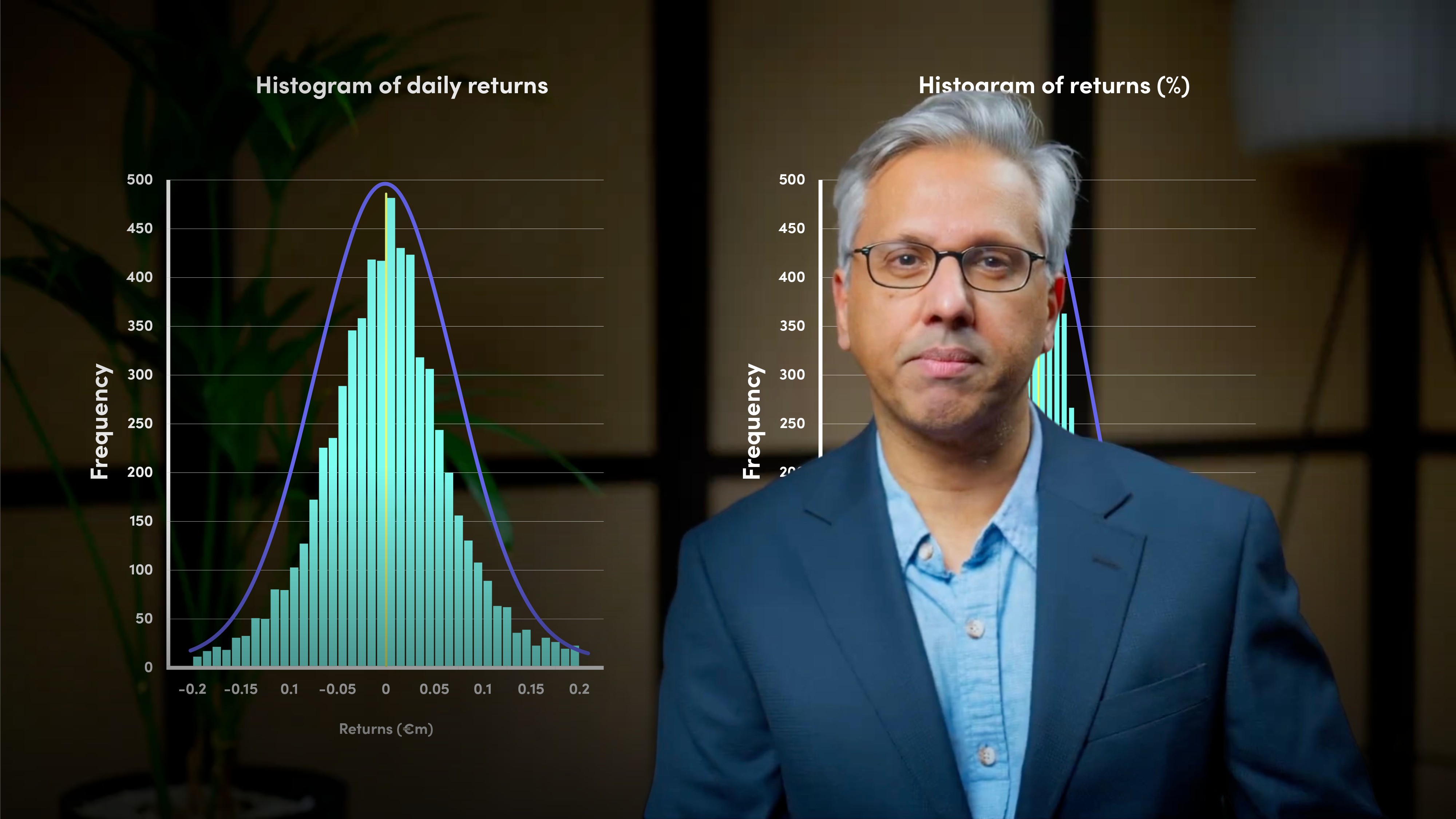

Calculate percentile-based risk measures for different confidence levels and convert 1-day VaR to 1-month VaR

Interpret VaR results and recognise the assumptions and limitations of the method

Overview:

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

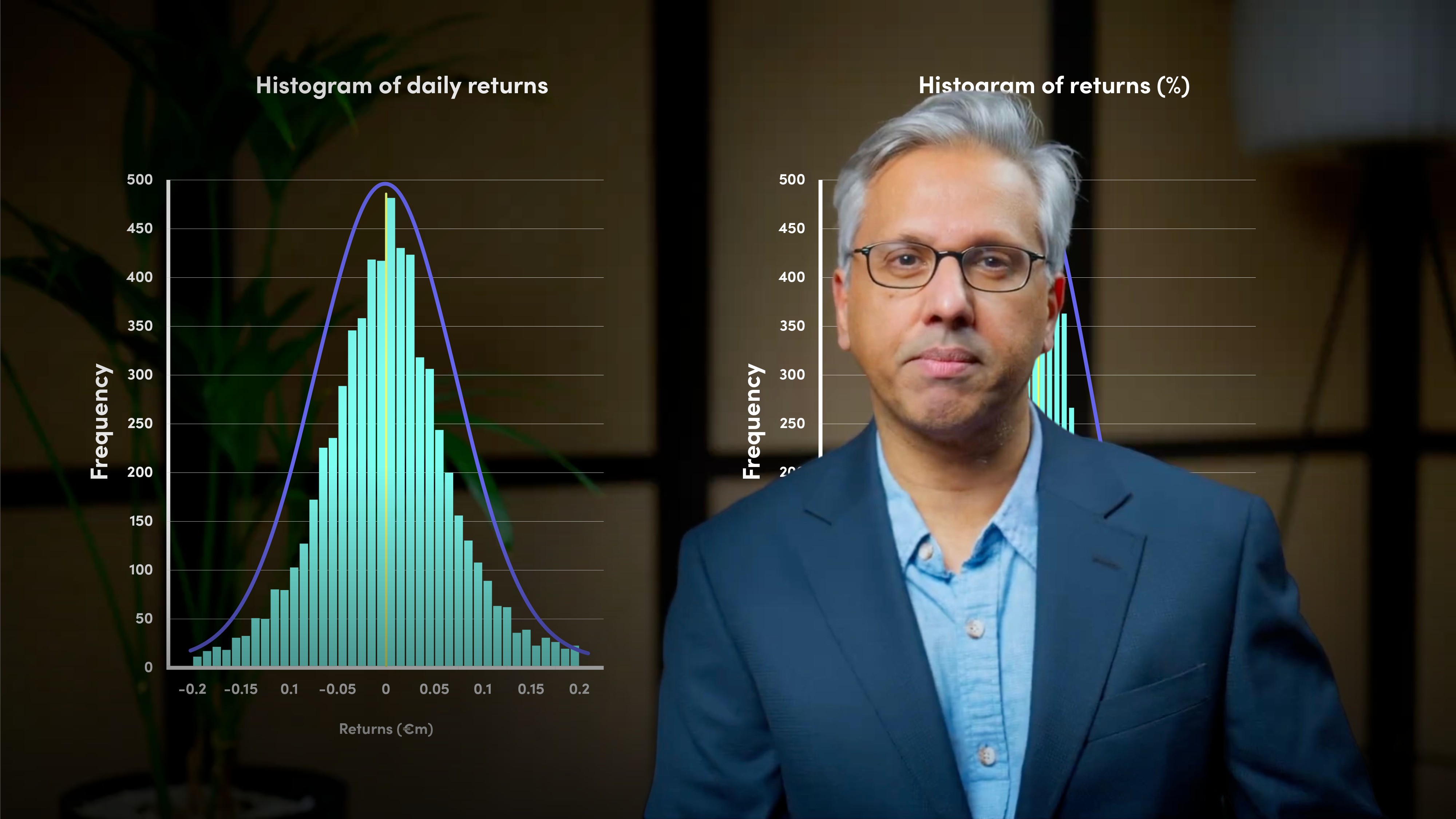

Because it relies purely on historical returns, the method:

- Captures real market features such as volatility clustering, shocks, and fat tails.

- Avoids assumptions about how returns are distributed.

- Is transparent and easy to audit, since every result can be traced to a real past event.

- A 95% confidence level → focus on the 5th percentile loss

- A 99% confidence level → focus on the 1st percentile loss

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"