Voluntary Carbon Market Ecosystem

Sam Hope

5 years: Carbon Markets

In this video, Sam explains how the carbon markets started, evolved, and function to finance climate action through private investment.

In this video, Sam explains how the carbon markets started, evolved, and function to finance climate action through private investment.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Voluntary Carbon Market Ecosystem

12 mins 36 secs

Key learning objectives:

Understand the origin of carbon markets

Outline the core carbon principles

Outline the steps taken to develop the UN CDM

Understand how to buy carbon credits

Overview:

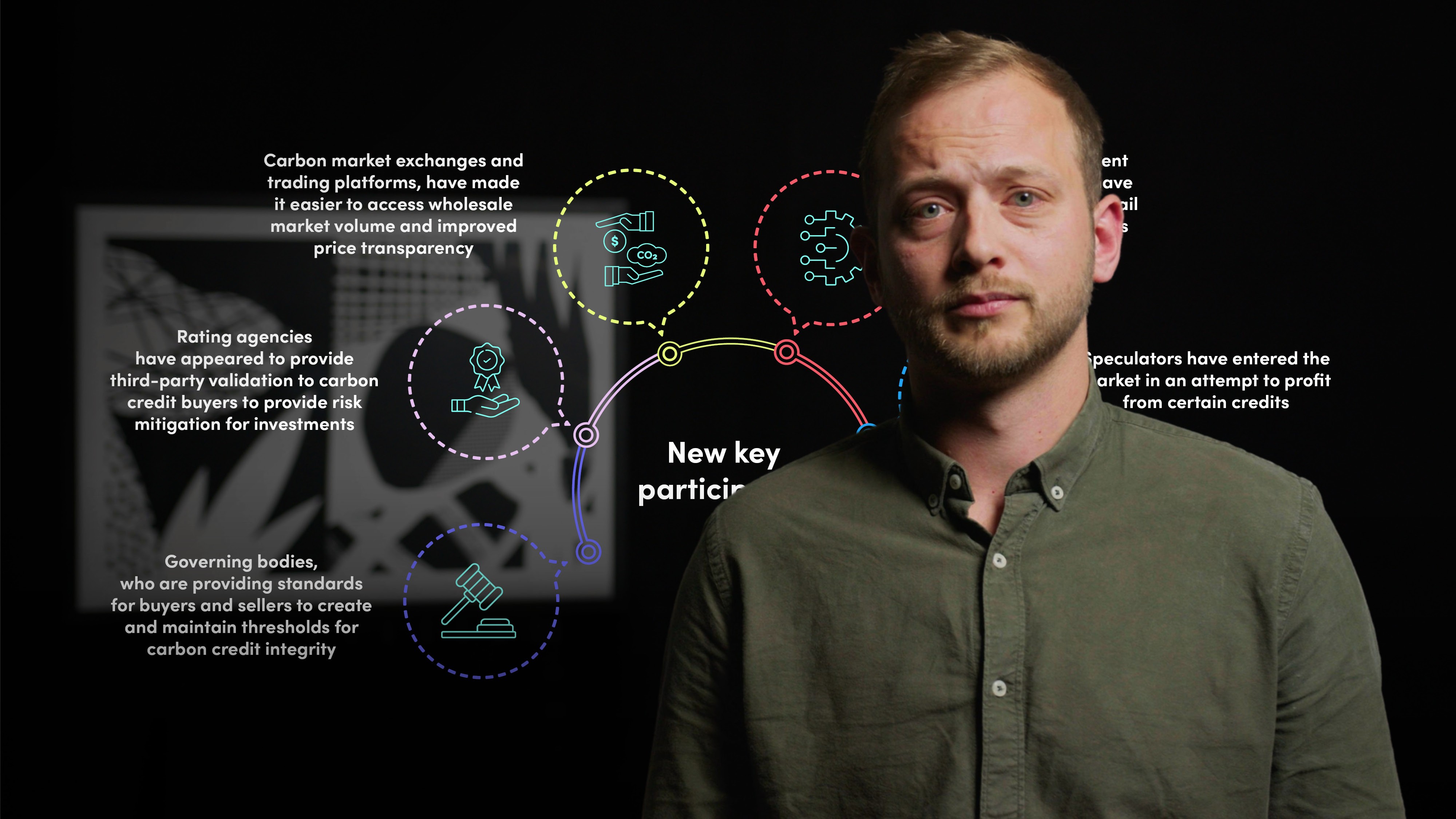

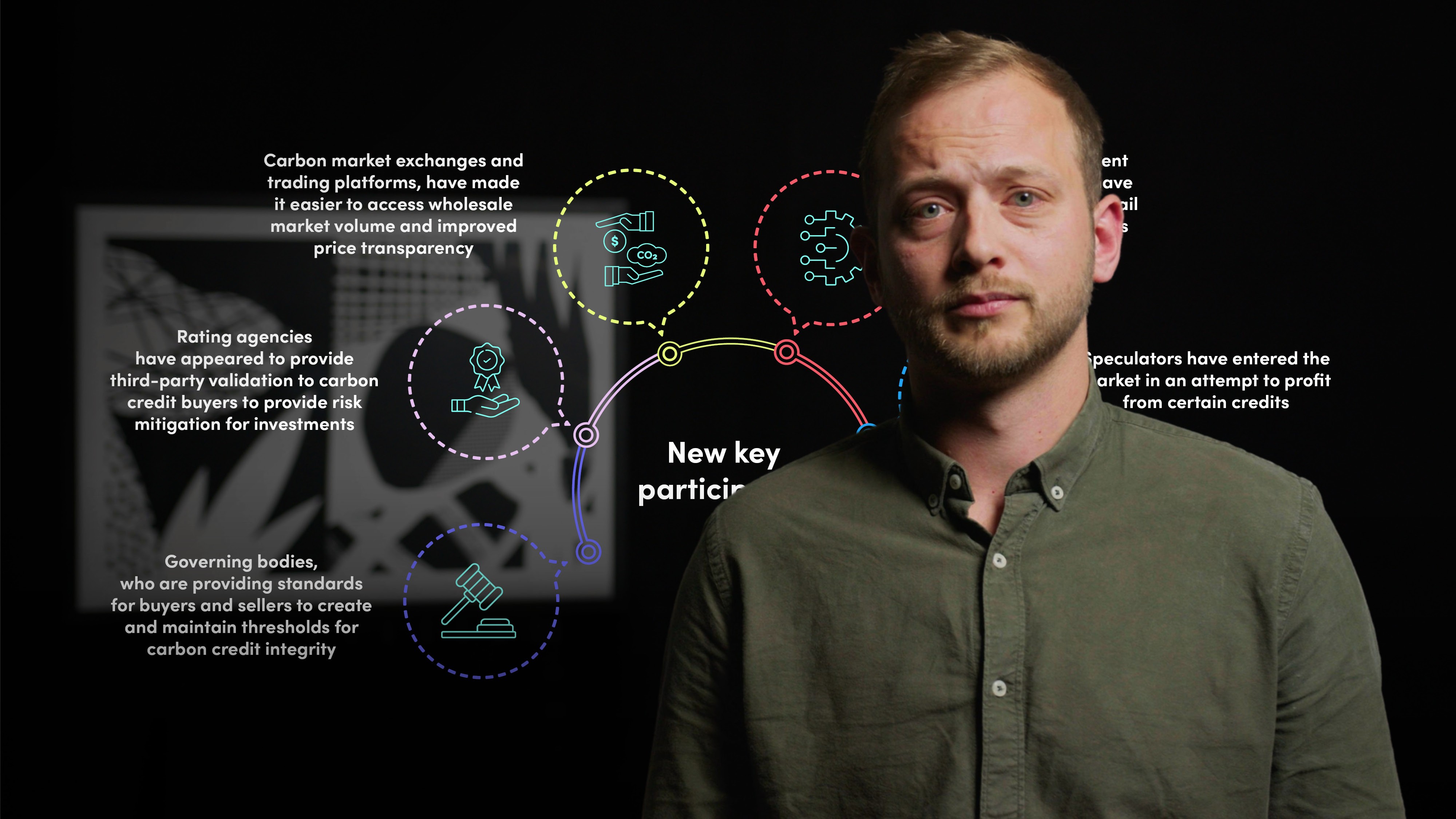

The voluntary carbon markets have grown as a means to limit atmospheric emissions and support the growth of developing countries, with a focus on market governance and integrity. While there are many initiatives aimed at standardising and increasing transparency, the complexity of the participants can make it difficult for offset buyers. However, the demand for a high-integrity marketplace is there, and accelerating support for the voluntary carbon market is crucial to scaling global green development and carbon removal in line with net zero. It is important to not let perfection be the enemy of good and to utilise this genuine tool to combat climate change.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the Kyoto Protocol and how did it establish the foundation for the voluntary carbon markets?

The Kyoto Protocol was the first international agreement on binding greenhouse gas emissions levels for developed countries and established the market mechanisms for developing carbon credits. It committed industrialised countries and economies in transition to reduce greenhouse gas emissions in accordance with agreed individual targets. The establishment of flexible market mechanisms, based on the trade of emissions permits, was a crucial element of the Protocol. These mechanisms encourage GHG abatement to start where it is most cost-effective and viable, for example, in the developing world, and stimulate green investment and the private sector's involvement in limiting GHG emissions.

What are the four core carbon principles that project developers must demonstrate to issue carbon credits?

The four core carbon principles that project developers must demonstrate to issue carbon credits are:

- Quantification

- Additionality

- Leakage

- Permanence

What is the UN Clean Development Mechanism (CDM) and how does it work?

The UN Clean Development Mechanism (CDM) is a standard that provides a framework for developers to implement projects across various project types, which can generate Certified Emissions Reduction (CER) credits for each tonne of carbon dioxide equivalent emissions they prevent from entering or remove from the atmosphere. The process involves a project developer choosing an appropriate registry-approved methodology or submitting their own for validation, creating a Project Design Proposal to be submitted via a third-party validator to the CDM, getting the project registered within the registry, progressing to project implementation and monitoring emission reduction levels, having emission reduction calculations certified by a registry-approved third-party verifier, and then selling carbon credits to willing buyers. The CDM has registered more than 7.5 thousand projects since 2004, and although it initially facilitated lots of projects, the system suffered from a large surplus of credits resulting in low pricing and a lack of quality in the offsets, which created an opportunity for other registries to emerge.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sam Hope

There are no available Videos from "Sam Hope"