What are Risk Weighted Assets?

Sukhy Kaur

15 years: Debt capital markets

In this video, Sukhy introduces what risk-weighted assets are and why they are used. She also outlines how we determine the risk-weighting of an asset and introduces the BCBS, the standard setter responsible for the prudential regulation of banks.

In this video, Sukhy introduces what risk-weighted assets are and why they are used. She also outlines how we determine the risk-weighting of an asset and introduces the BCBS, the standard setter responsible for the prudential regulation of banks.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What are Risk Weighted Assets?

8 mins 20 secs

Key learning objectives:

Understand the purpose of risk-weighted assets

Understand how the risk-weighting of an asset was determined under Basel I

Overview:

Risk-weighted assets (RWAs) are used to determine the minimum amount of capital that a bank should hold as a reserve in order to reduce the risk of becoming insolvent. Banks first had to hold capital against the credit risk they took following the introduction of Basel I. The rules surrounding required capital have been developed and evolved through the different iterations of the Basel Accords as they are paramount in maintaining the financial stability of the banking system.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

What is the purpose of risk-weighted assets (RWAs)?

Given a large portion of a bank’s assets consist of loans and mortgages, they face the risk that borrowers may default on their repayments. By ensuring the bank maintains a minimum amount of capital against these assets, it helps the bank to offset this risk and remain solvent, and this is where RWAs come in. RWAs are used to determine the minimum amount of capital that a bank should hold as a reserve in order to reduce the risk of becoming insolvent.

Risk-weighted assets are determined based on the level of perceived credit risk. For example, if a bank has given a loan to an oil company and they also hold a US Treasury Note. The loan will entail a higher level of credit risk due to the risk of the company not being able to repay the loan, whereas the US Treasury Note has a very low risk due to it being backed by the US Government. In this case, the bank would have to hold a much higher level of capital against the bank loan over the Treasury Note.

How were risk-weighted assets calculated under Basel I?

Right weighting rules are set by the Basel Committee on Banking Supervision (BCBS). The first set of capital adequacy rules was introduced with the implementation of the Basel 1 Accord in 1988.

Under Basel I, asserts were classified into 5 categories of risk-weighting, 0% risk-weighting for high-quality assets (cash and government bonds), up to 100% risk-weighting for lower-quality assets (private-sector debt).

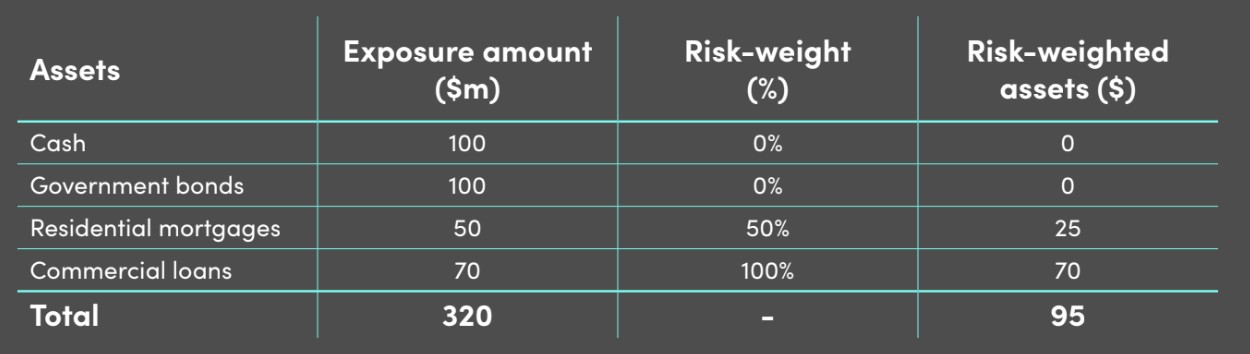

Say a bank has the following balance sheet items and exposure amount:

We can see each item's associated risk-weight (determined using Basel I categories), and to determine the risk-weighted assets, we simply multiply the exposure amount by the risk-weight resulting in the following:

Therefore the bank has to hold $95m in capital against the $320m worth of assets it is holding.

Subscribe to watch

Access this and all of the content on our platform by signing up for a 7-day free trial.

Sukhy Kaur

There are no available Videos from "Sukhy Kaur"