Letter of Credit

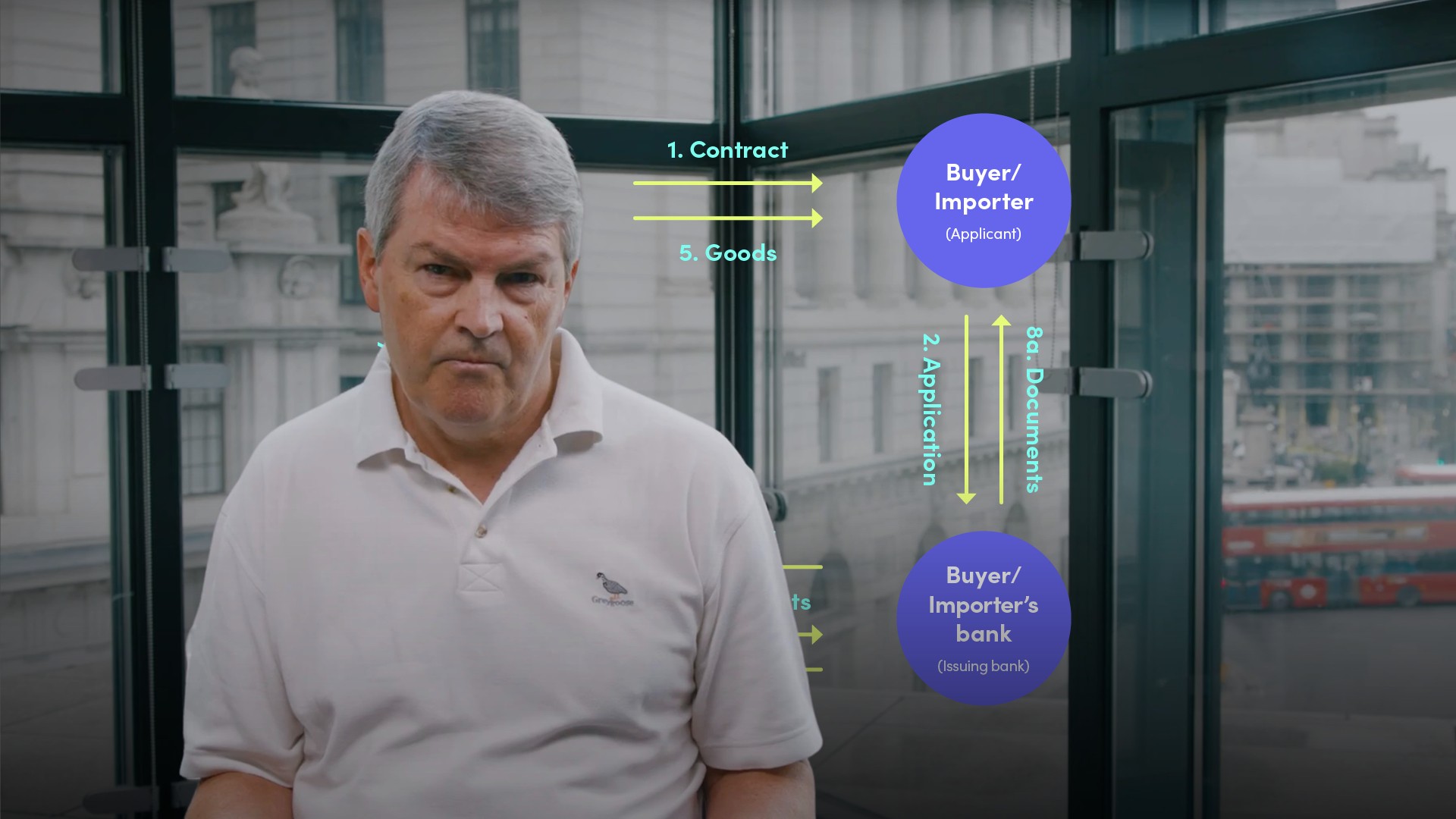

Letters of credit are used in trade finance to ensure that exporters will be paid on time for goods they supply and that importers receive the goods they have paid for on time. In effect, the seller is comforted by substituting the credit worthiness of the bank for the creditworthiness of the buyer. An export letter of credit is issued by the importer’s bank, undertaking – on behalf of the importer – to pay for the goods subject to the exporter meeting all terms of sale outlined in the Letter of Credit. If the L/C is confirmed by the exporter’s bank, the exporter additionally receives protection against payment default by the importer’s bank. An import letter of credit is issued by the importer’s bank to the exporter (on behalf of the importer). Import L/Cs secure payment for exporters provided the L/C terms are met. Terms will include presentation of documents such as bills of exchange, bills of lading, airway bills and invoices.