Your Quick Guide To The Outcomes Of COP28

David Carlin

Head of Climate Risk

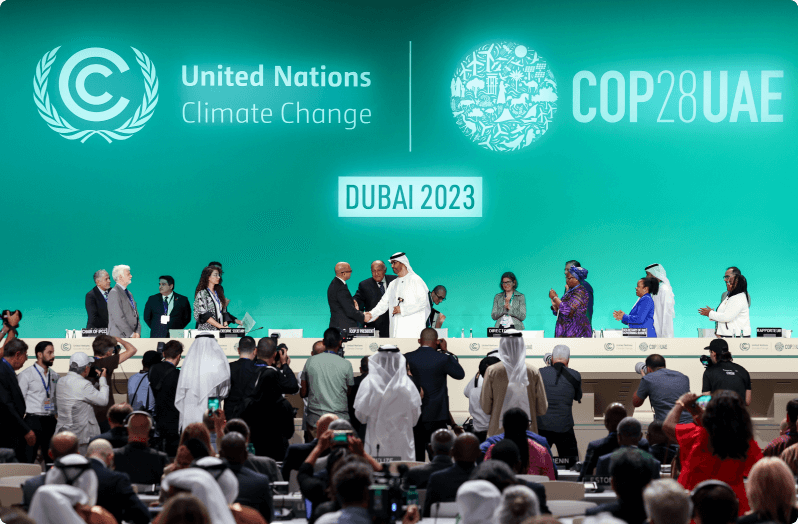

The world’s biggest climate meeting, the 28th conference of the parties (COP28), just concluded in Dubai.

Negotiators from around the world worked overtime to deliver a new plan for addressing the mounting crisis posed by human-caused climate change. Nations reached an agreement to fund assistance for those most impacted by climate change (loss and damage) and also to “transition away from fossil fuels in energy systems.” Despite important progress, COP28 fell short of delivering the decisive action on climate change that science says is needed. This article explores key decisions taken at COP28 and their respective highlights and lowlights.

Loss And Damage

COP28 saw a landmark agreement to support vulnerable nations facing the worst of climate change’s impacts. These can include: “the development of national response plans; addressing insufficient climate information and data, and promoting equitable, safe and dignified human mobility in the form of displacement, relocation, and migration, in cases of temporary and permanent loss and damage.” A geographically diverse board will be established, and the fund will be initially managed by the World Bank. The first pledges from wealthy nations were made in Dubai to support the fund and currently total over $650 million.

Climate Finance Target

Progress was finally made on the new collective quantified goal (NCQG), which builds on the $100 billion pledged by developed nations to finance climate mitigation and adaptation initiatives in developing nations. Notably, that $100 billion goal has not yet been met (although it appears on track this year) and is far short of what is needed. COP saw an agreement to draft a post-2025 finance target ahead of COP29. This is a step forward, but like loss and damage last year, the details will only be hammered out next year.

Global Goal On Adaptation

Continuing a theme from COP27, this COP saw emphasis put on supporting strategies for adapting to the impacts of climate change. The final text retains calls for a doubling in adaptation finance and plans for assessments and monitoring of adaptation needs in the coming years. Positively, an explicit 2030 date has been integrated into the text for targets on water security, ecosystem restoration, health. However, language was weakened around a commitment to closing the adaptation finance gap. Much of the financing language was pushed from the adaptation section into the implementation section of the COP text. Additional details on financing expectations and targets are needed at COP29.

Global Stocktake And Fossil Fuels

The Global Stocktake was most scrutinized text at COP28. After fierce pushback on the watered-down language on emissions and fossil fuels, the final text saw a few improvements. It mentions the projection of peak global emissions between 2020-2025. Alignment around emissions reductions consistent with the goals of limiting warming to 1.5 degrees Celsius above preindustrial levels and reaching net zero by 2050 now made explicit. The final text more strongly “called on” nations to take a variety of actions to reduce emissions. It also stated the intention of “accelerating and substantially reducing non-CO2 emissions globally, including in particular methane emissions by 2030.”

Unfortunately, some concerning language also made it into the final draft. That included weakening the coal statement from "rapidly phasing down unabated coal" and putting "limitations on permitting" to just speaking about "efforts towards the phase-down of unabated coal power." A paragraph now also mentions the role of "transitional fuels" read: gas (and perhaps oil) in the energy transition. On the central fossil fuel language, a “transition away” is called for rather than a “phaseout.” Notably, it only directly refers to fossil fuel use in in energy systems.

Carbon Markets

Another closely watched area in Dubai was on carbon markets. Carbon markets are systems where countries or entities can buy and sell carbon credits, representing a reduction of greenhouse gases, to meet their climate targets. These markets can encourage cost-effective emissions reductions by providing financial incentives for emission-reducing projects. However, these markets have also been plagued by credibility concerns. Negotiators were trying to further define how credit markets would be supervised and how different types of credits would be accounted for. No agreement was reached and so key questions related to the permanence of the reductions/removals claimed will need to be addressed at COP29. This is an unfortunate outcome for those seeking to build vibrant and high-integrity carbon markets.

Other Key Themes (Just Transition And Nature)

The final COP text included some important call-outs of the importance of delivering a just transition. The just transition was an important focus in the Global Stocktake, Global Goal on Adaptation, climate finance, and implementation agreements. However, more work will be required on what the just transition means in quantitative terms from emissions trajectories to climate finance obligations. Nature was also mentioned directly in the Global Goal on Adaptation, which spoke of “accelerating the use of ecosystem-based adaptation and nature-based solutions,” and there is growing recognition that climate goals demand nature-positivity. A promising 2030 deforestation goal was also part of the final text.

Cop29 Host

Baku in Azerbaijan will host COP29, avoiding an extension of the UAE presidency and a conference location in Bonn, Germany. This agreement was reached after Armenia and Russia dropped their objections.

Overall

The UAE hosts effectively managed the logistics of the largest COP in history. The conference reached landmark agreements on loss and damage and a clear ambition to transition away from fossil fuels. However, in the final accounting, much of the agreement feels like incrementalism. Against the urgency of the moment, during the hottest year on record, when giant leaps are needed, small steps are not enough.

This article originally appeared in Forbes.

David Carlin

Share "Your Quick Guide To The Outcomes Of COP28" on

Latest Insights

UBS and Switzerland: Capital hikes are not the right tool for the job

15th October 2025 • Prasad Gollakota

Trade deals & trade wars: The regional impact

23rd May 2025 • Adrian Pabst and Eliza da Silva Gomes

Unpacking the truth behind U.S. Treasury market volatility

17th April 2025 • Prasad Gollakota