Our content standards

World-leading experts

World-leading experts

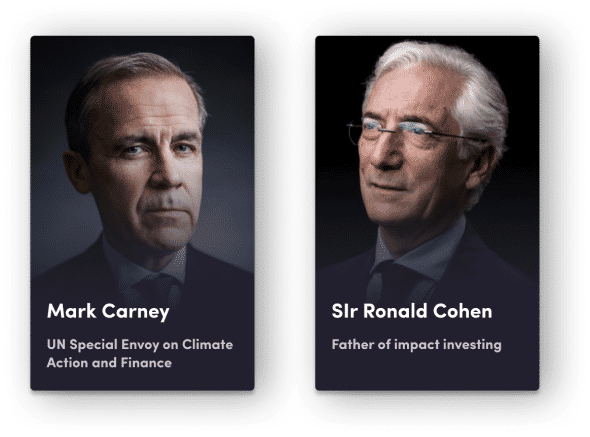

Our expert contributors are hand-picked by our team for their expertise and practical experience working for and with the world’s leading financial institutions.

Whether you’re learning from someone you might have heard of, such as UN Special Envoy Mark Carney or “Father of Impact investing’ Sir Ronald Cohen, or from someone less well-known, we undergo a thorough scoring and selection process so you can rest assured that you are learning from the very best in each field.

Proven educational frameworks

Proven educational frameworks

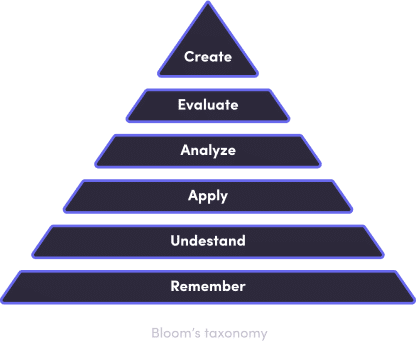

At Finance Unlocked, our aim is to enable learners to understand and retain fundamental concepts, and then be able to apply them in a useful context. We structure our content based on two learning theories:

We use Bloom’s taxonomy to set objectives for our content and Gagné’s nine levels of learning helps us to achieve those objectives. To find out more about our learning philosophy, get in touch.

Premium production standards

Premium production standards

We own the content production process front to back. Our courses are meticulously planned before being shot on-location with our pro film and sound crew. We then add clear illustrations and animations, created by our dedicated team of analysts, designers and animators, to help explain and demystify difficult topics.

Accredited by top industry bodies

Accredited by top industry bodies

All of our pathways and courses are endorsed by the top industry associations and accredited by the industry’s leading certification bodies. These organisations continually assess our content and only certify it if it meets the highest educational standards.

Partners

Partners

Our technical standards

Proprietary

Our platform is completely proprietary. This means we have the ability to change any part of it in response to customer feedback. The platform will continue to develop exclusively towards your needs.

Intuitive

Finance Unlocked has been built to be familiar to anyone who is used to using online video platforms such as Netflix.

Our recommendation engine and search functions use AI to ensure that learners’ queries are understood, and they can get to the education they need, when they need it.

Secure

Net-zero

Finance Unlocked is a founder member of TechZero, which publicly reinforces our commitment to achieve net zero carbon emissions by 2022. We regularly measure our carbon footprint, and look to actively reduce our carbon emissions wherever we can.

We offset any residual carbon footprint which we are unable to mitigate.

We have been carbon neutral since December 2021.

Social impact

Outside of business as usual we have been involved in various social impact initiatives including educating 8,500 students during COVD-19 university closures, educating 3,000 black students in partnership with Santander, partnering with Innovate Finance on their Fintech for Schools initiative and contributing to the Chartered Banker 2025 foundation.

By submitting this form, you agree to our terms and privacy policy