Sink or Swim? The 8 Things New Joiners in Finance Need to Learn in Their First 6 Months

By Rob Ellison

“ What knowledge do all new finance professionals most desperately need to acquire? ”

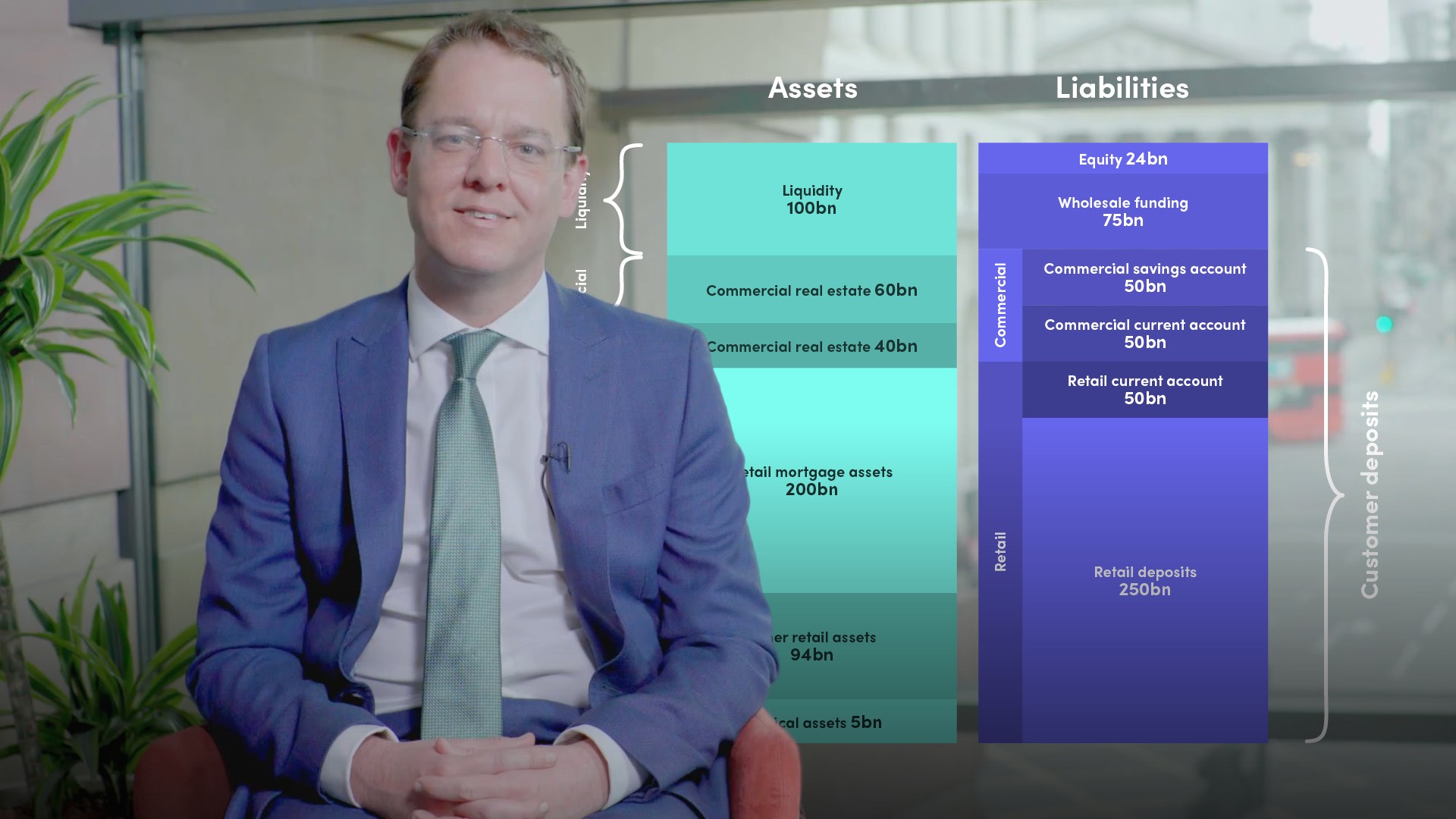

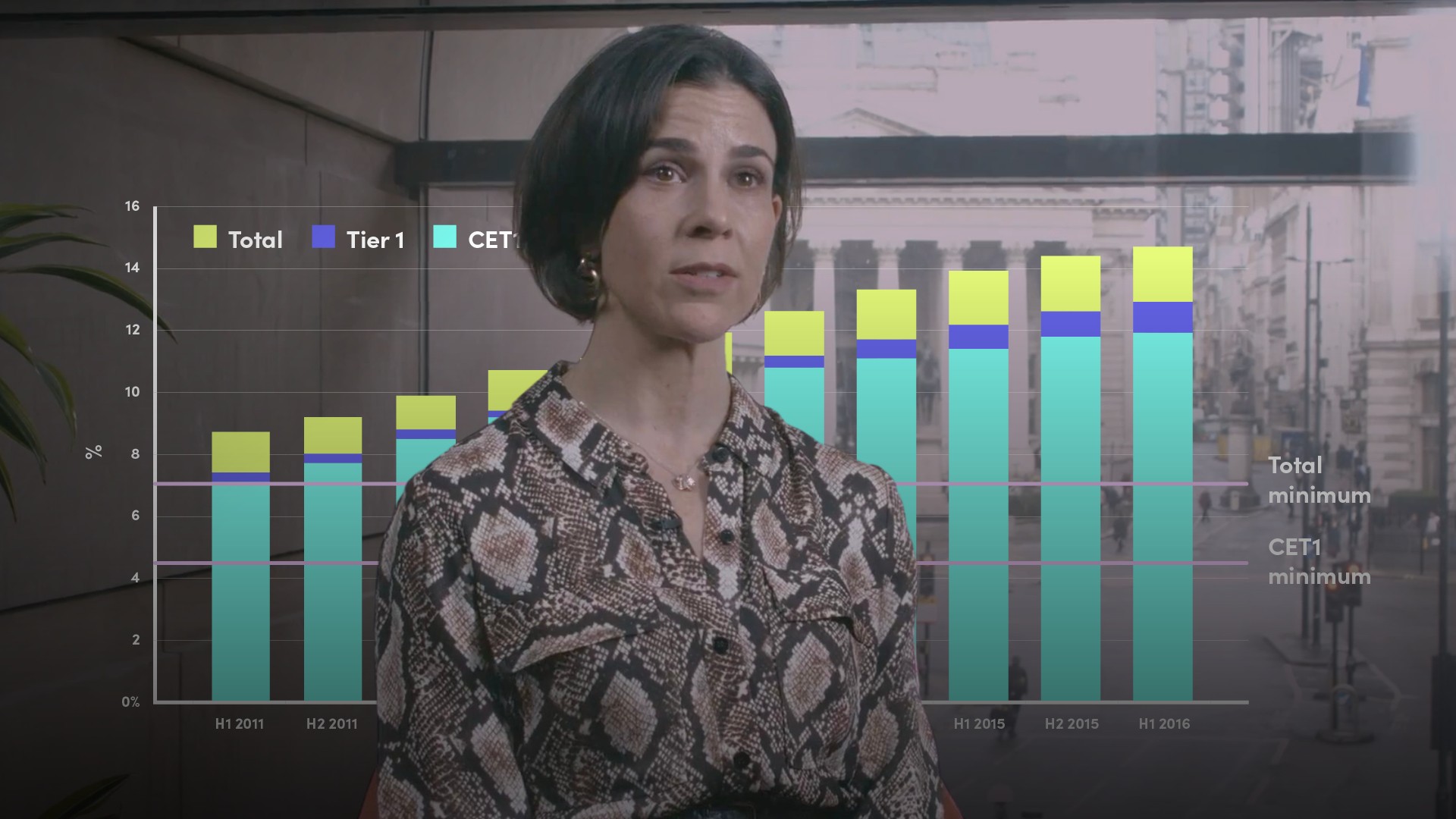

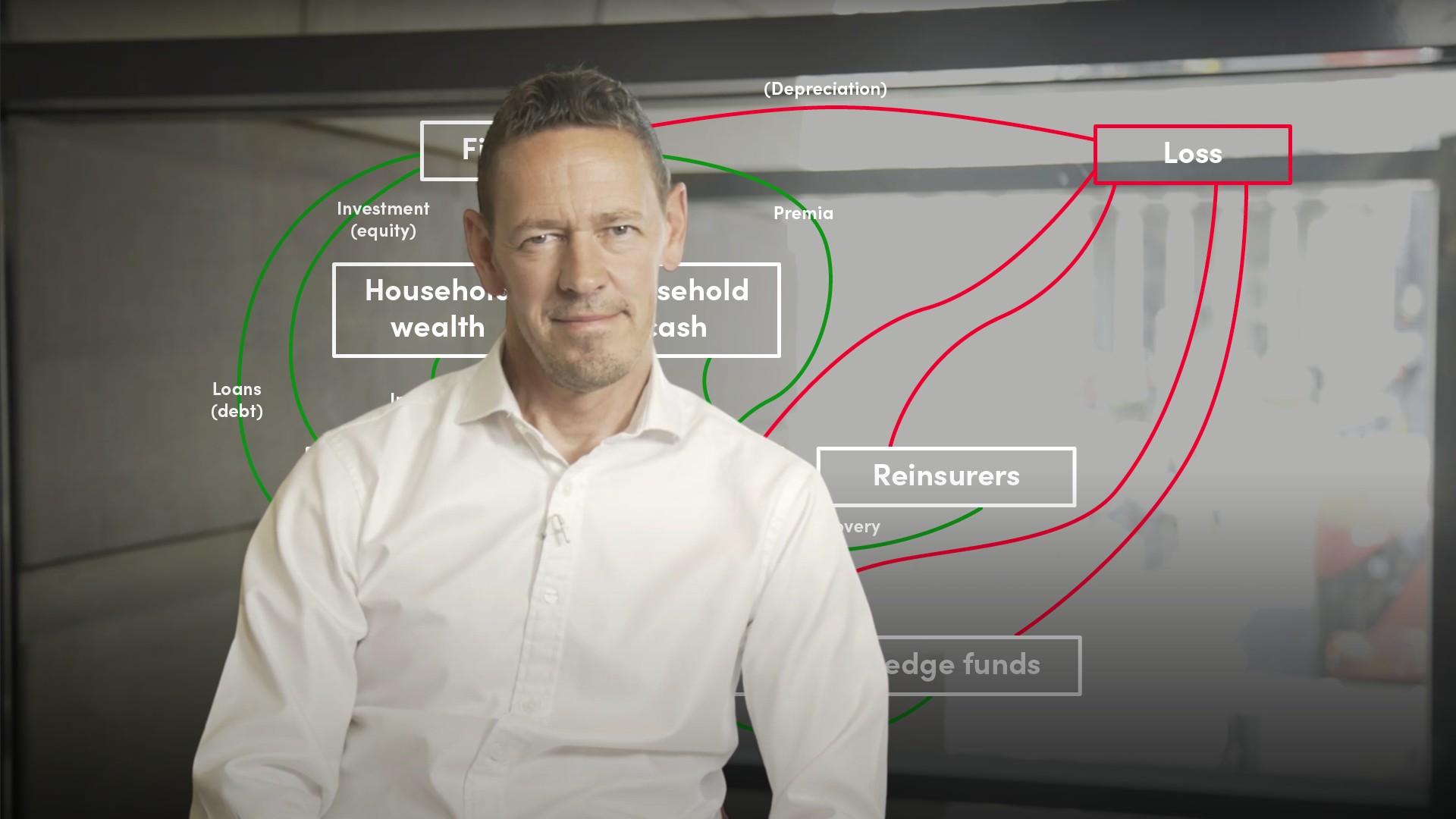

#1: The Basics

#1: The Basics

Finance Fundamentals - Video Playlist

#2: The Lingo

#2: The Lingo

“ It was almost like an unintentional hazing, you inevitably get taken down a few levels, and it hurts. ”

Learn from the experts.

Finance Unlocked content is presented by finance practitioners, who use real finance terms, in context, and explain terms properly as they arise. Our experts are the ideal mentors for your 2021 grad intake.

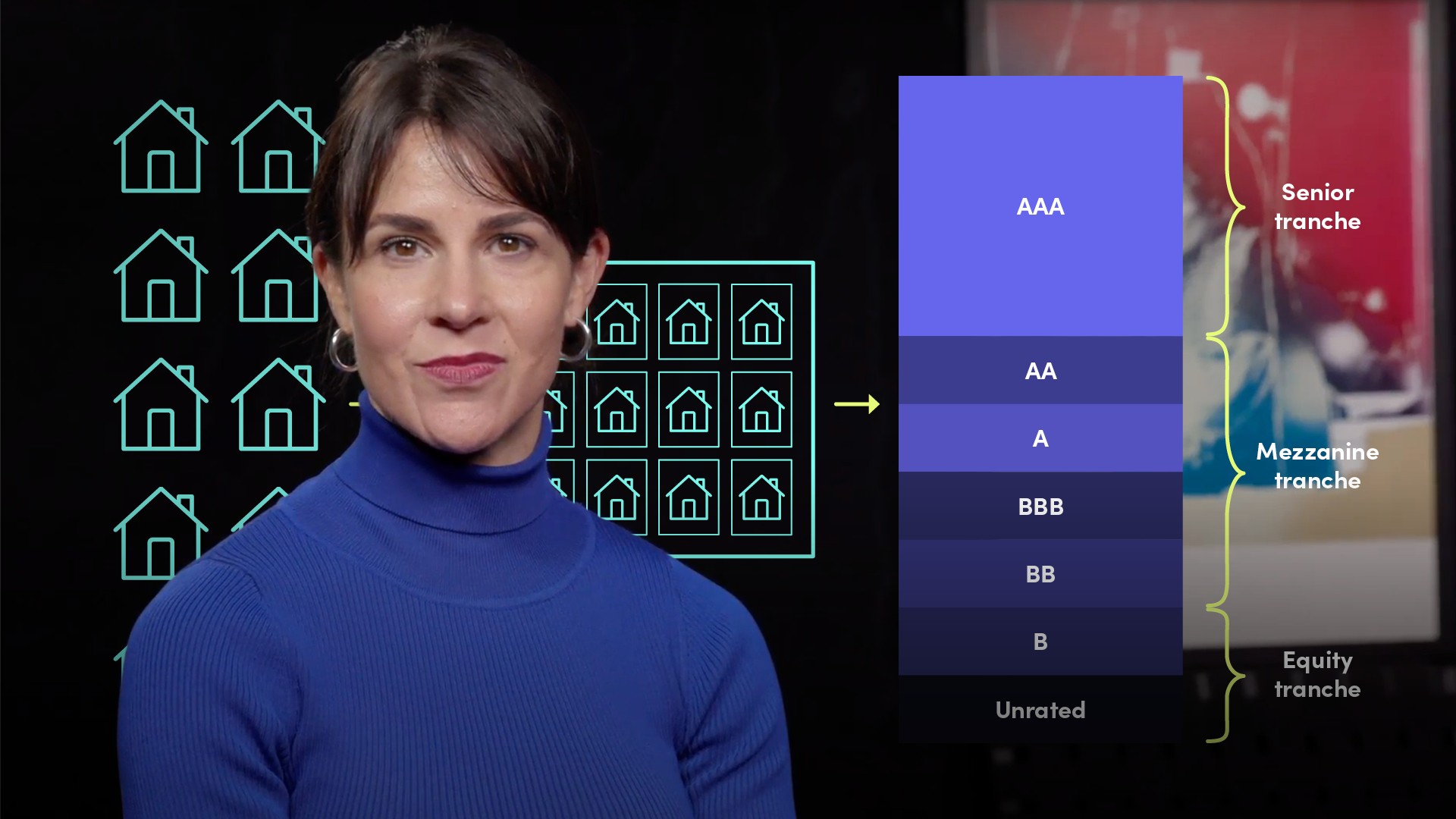

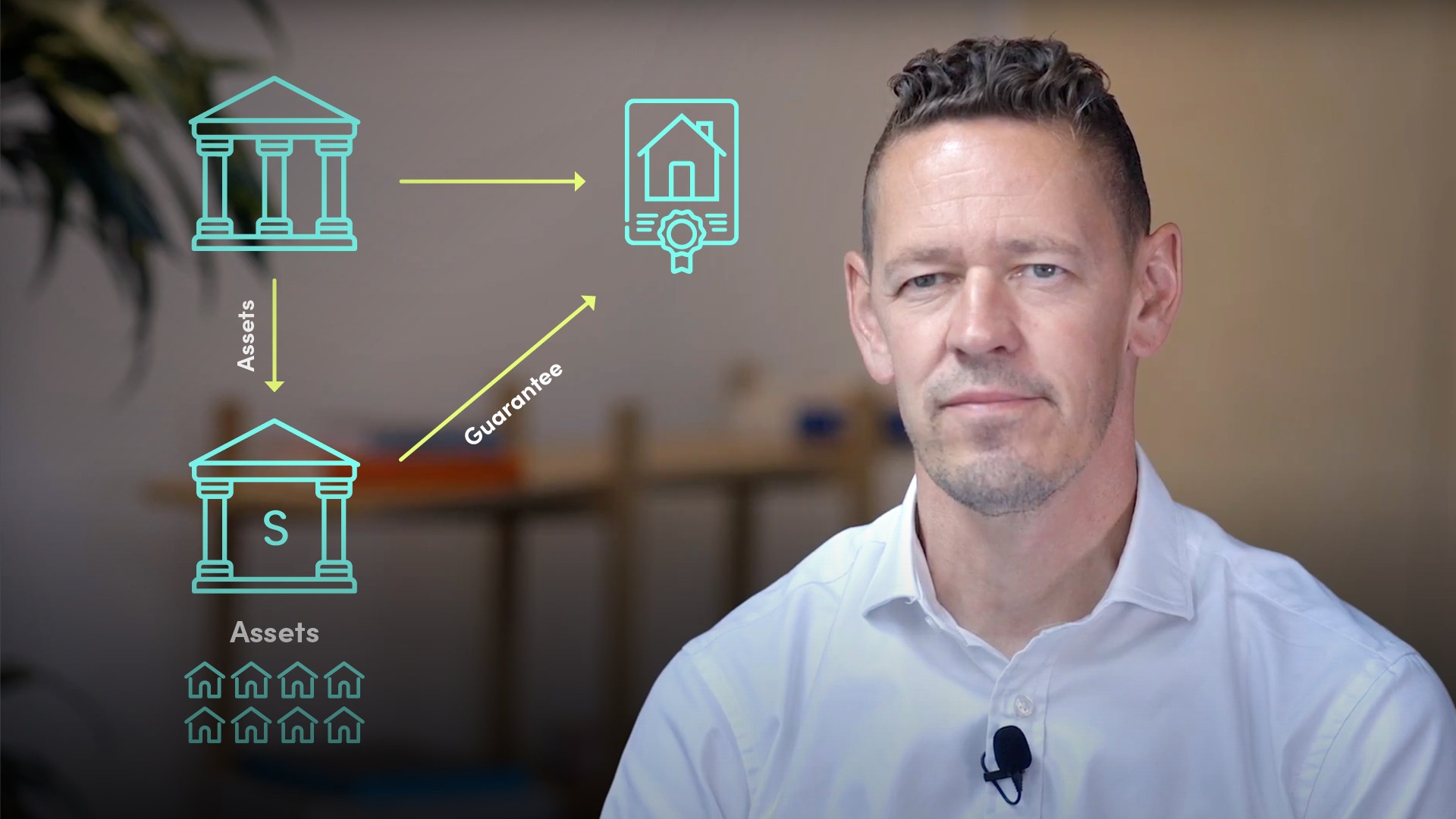

#3: Role-specific skills

#3: Role-specific skills

“ Investment bankers won’t need to know the intricacies of how to price an interest rate swap, they do need to be very comfortable building a financial model. ”

#4: How not to go to prison

#4: How not to go to prison

Our compliance courses

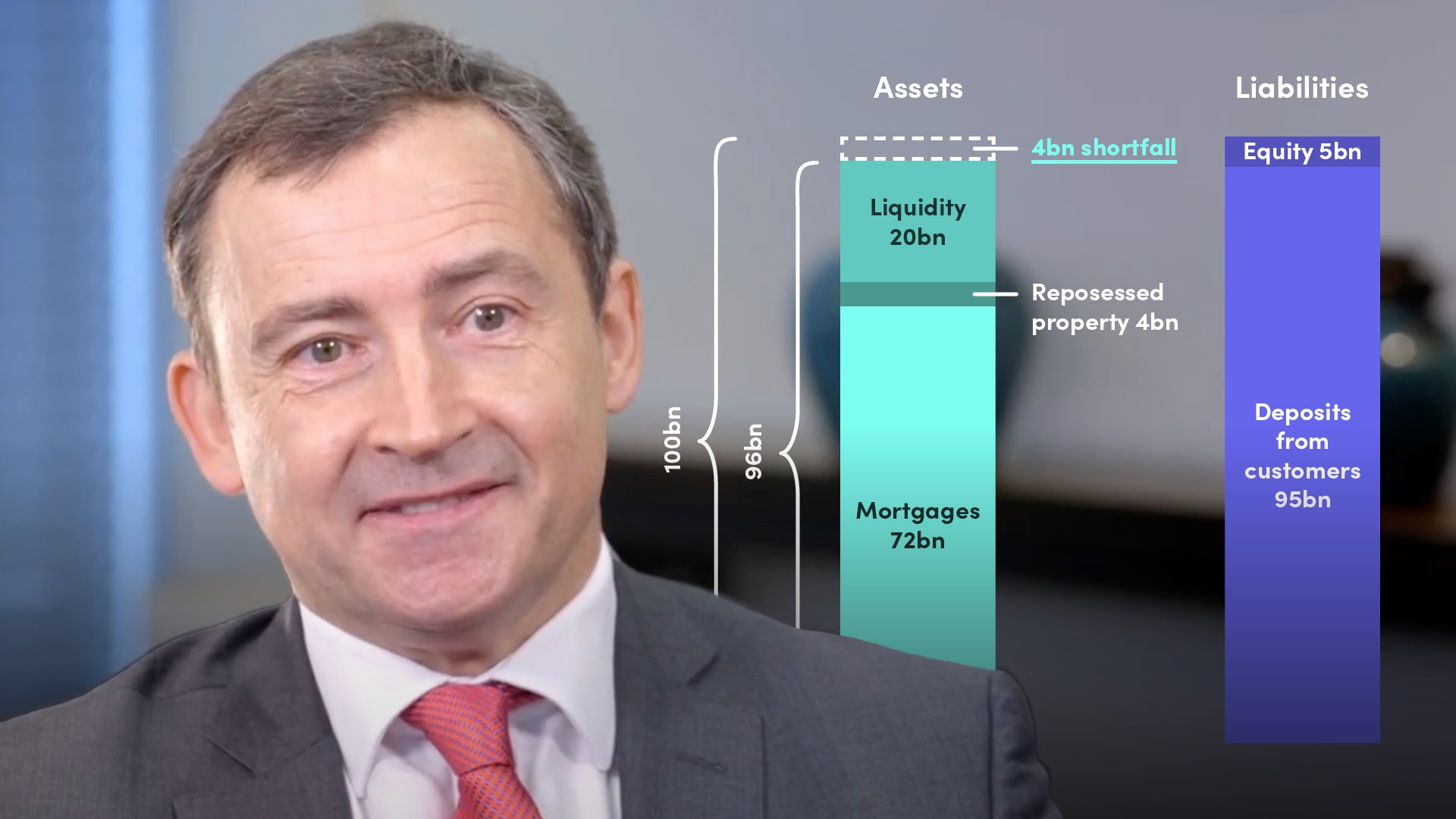

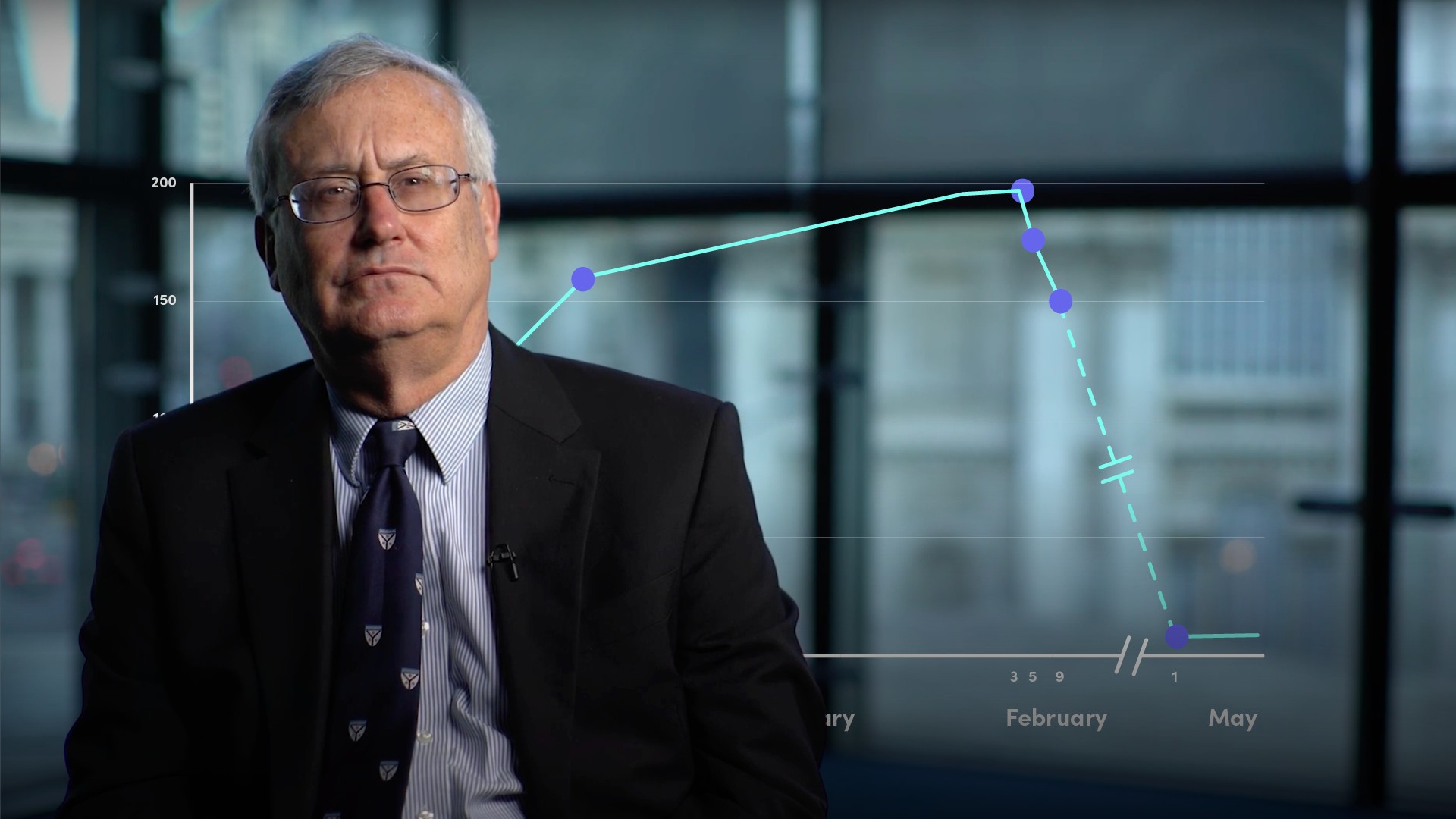

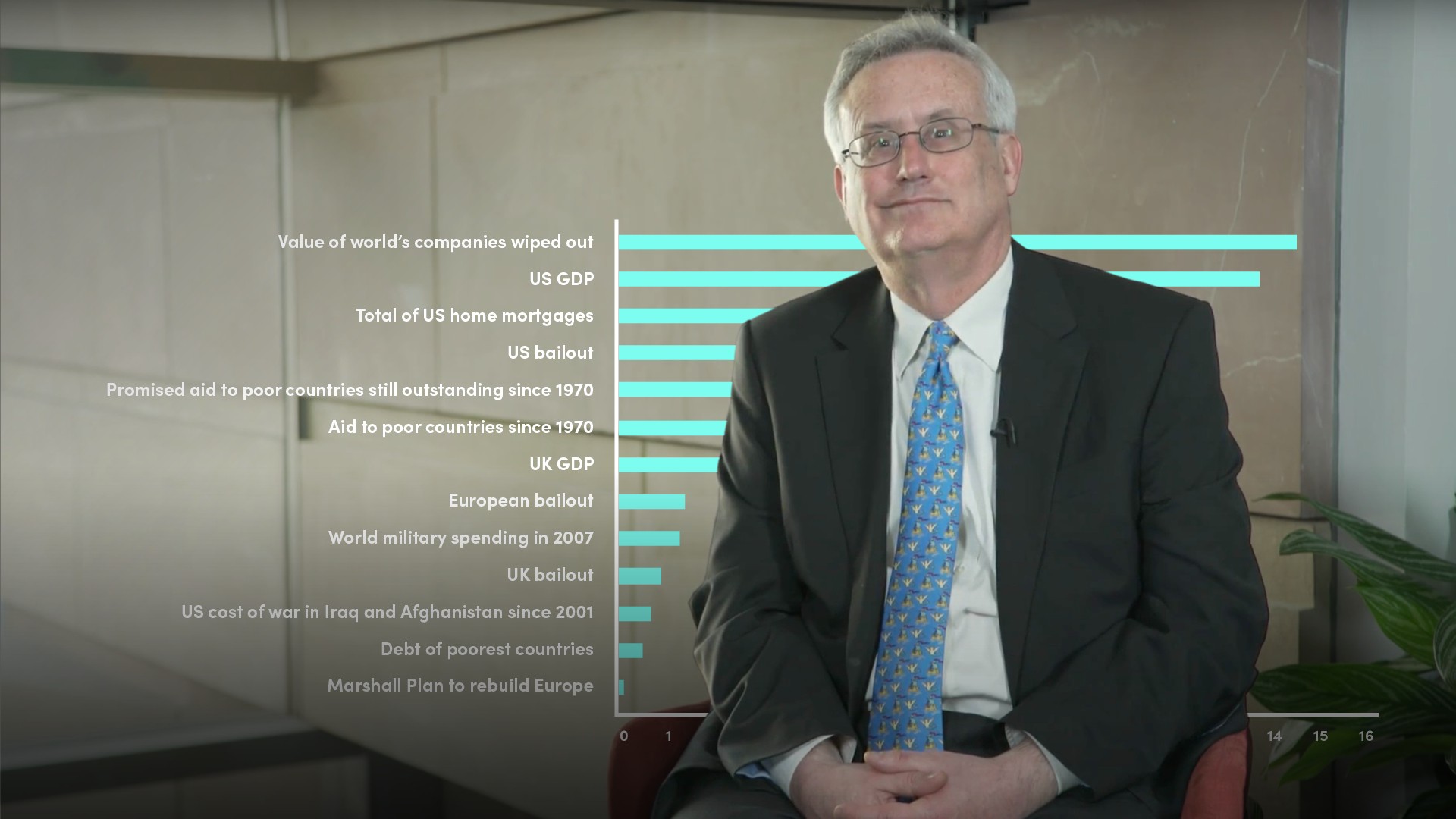

#5: History

#5: History

Learn financial history on Finance Unlocked

#6: Who matters most?

#6: Who matters most?

#7: Why is everyone doing what they’re doing?

#7: Why is everyone doing what they’re doing?

Trusted by:

Trusted by:

#8: Your role in the great project of your generation

#8: Your role in the great project of your generation

A selection of our ESG courses

Deliver the best possible finance education to your new joiners - contact us to today to learn how.

Message us here or visit our FAQ page to get answers to the most commonly asked questions